It is done - I have successfully migrated the shop pages to their new server, and imported everything that was on this blog to the new blog - which you will find at www.pallia.net/blog (or, alternatively, blog.pallia.net). Please adjust your bookmarks and tell your friends! If you're getting an RSS feed, the new feed address is www.pallia.net/blog/feed, though I've put a redirect in here (which means you should get the new posts, and probably will not get this one. Which is just to tell people that things have changed, and where to find the blog now anyways.)

So this is where we part our ways, blogspot. It was a nice time with you - almost seven years, in fact, and I enjoyed hanging out here and posting stuff. But my requirements have changed, and my taste in design has hopefully improved, and I really wanted all my stuff together in one place for a change.

Well. Goodbye, and thanks for all the fish. I'll see you readers over at the new place (where you'll also find a proper blogpost).

Thursday 19 November 2015

Wednesday 18 November 2015

It is time. Things are moving.

I've been getting an early start today, and you are getting a very, very early blog, because of this:

I've started the server migration, and I'm already really, really happy that I did test-runs of almost everything before, and took copious notes. This way, my panic probability is much reduced, even if something does not go quite as planned.

Like my database fooling me into thinking it had not imported, thus trying to re-import... and getting an error message. Obviously.

If you're interested in following the shenanigans in detail, I'll be tweeting live about this - you find me on twitter as katrinkania, and I'm using the hashtag #newserverorbust.

I've started the server migration, and I'm already really, really happy that I did test-runs of almost everything before, and took copious notes. This way, my panic probability is much reduced, even if something does not go quite as planned.

Like my database fooling me into thinking it had not imported, thus trying to re-import... and getting an error message. Obviously.

If you're interested in following the shenanigans in detail, I'll be tweeting live about this - you find me on twitter as katrinkania, and I'm using the hashtag #newserverorbust.

Tuesday 17 November 2015

Finally - it's all done!

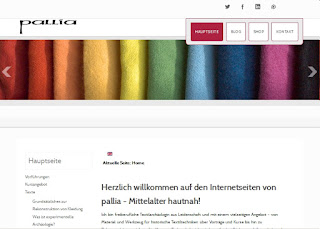

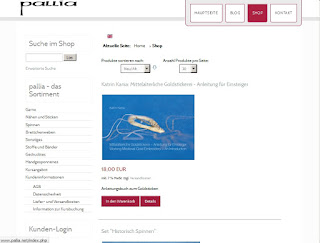

The website redesign is finally all done and finished. There's a few more articles I'd like to add to the main page, but they are not time-critical - and the rest is all done. The menu structures are fine, all the links seem to be working, and a few of the remaining tweaks and checks can only be done once the site is connected.

I've tried hard not to waste too much time on small things, but then sometimes it's the small things that make all the difference. So now and again, I spent a few hours trying to get something to work because it would be oh so pretty, or oh so cool. A good bunch of hours was also used up because I had to learn something new - how to handle css stuff, or how I have to build the menu structure in Joomla! for my breadcrumbs to work properly, or how to size and position an svg grapic. (SVGs are cool. They are vector graphics that you can have your browser draw, so they are nice and nifty and resize very, very well. If you know how to resize them - so in case you need somebody to explain it to you, too, here's a wonderful blogpost about it.)

So tomorrow will be the day - I'll take the old shop offline, migrate the data to the lovely new shop, and then ask for the connection to be made. That will probably take between a few hours to a day or even two, depending on how fast the name-servers catch the update. This is all very, very exciting, and I hope it will all go well!

I've tried hard not to waste too much time on small things, but then sometimes it's the small things that make all the difference. So now and again, I spent a few hours trying to get something to work because it would be oh so pretty, or oh so cool. A good bunch of hours was also used up because I had to learn something new - how to handle css stuff, or how I have to build the menu structure in Joomla! for my breadcrumbs to work properly, or how to size and position an svg grapic. (SVGs are cool. They are vector graphics that you can have your browser draw, so they are nice and nifty and resize very, very well. If you know how to resize them - so in case you need somebody to explain it to you, too, here's a wonderful blogpost about it.)

So tomorrow will be the day - I'll take the old shop offline, migrate the data to the lovely new shop, and then ask for the connection to be made. That will probably take between a few hours to a day or even two, depending on how fast the name-servers catch the update. This is all very, very exciting, and I hope it will all go well!

Posted by

a stitch in time

at

15:40

0

comments

Labels:

the market stall,

websites and mailing lists,

work-related

Labels:

the market stall,

websites and mailing lists,

work-related

Monday 16 November 2015

Behold the Stretchiness of Sprang.

I've already hinted that I did some sprang at the Textile Forum - and it was an utter joy to do. My previous dabblings in this wonderful technique had always fizzled and died before I got to the stage where I could understand what is going on. Add in a few misunderstandings (I had a knot in my brain and didn't really get what the instructions were trying to tell me) and the resulting mistakes, and there is no chance in really getting it at all.

For those of you who have little question marks hovering above your heads - sprang is a braiding technique where you braid on ends (or elements) that are stretched in a frame. You work in the middle, in a shed, crossing threads from the back with threads from the front, and your work grows from the top and bottom edge towards the middle. Once you are in the middle, you have to secure it in some way to prevent unravelling.

This time around, however, sprang finally clicked for me. Plus I finally got to use a ball of lovely cotton yarn that some friends had given me as a present years ago - a single ball of cotton, about 230 m length, so not really a thing to knit with, and not something suitable for historical stuff.

It made a wonderful bag, though:

This is the little bag hanging out next to a 1.5 l bottle of water, for size comparison.

And this picture will show you the amazing stretchability of sprang:

Yes, it will hold four of these water bottles without complaint. It might even hold five, but the cord drawn in at the top (the other place where you have to secure your elements) limits the maximum opening of the bag's top. I think it's still impressive.

For those of you who have little question marks hovering above your heads - sprang is a braiding technique where you braid on ends (or elements) that are stretched in a frame. You work in the middle, in a shed, crossing threads from the back with threads from the front, and your work grows from the top and bottom edge towards the middle. Once you are in the middle, you have to secure it in some way to prevent unravelling.

This time around, however, sprang finally clicked for me. Plus I finally got to use a ball of lovely cotton yarn that some friends had given me as a present years ago - a single ball of cotton, about 230 m length, so not really a thing to knit with, and not something suitable for historical stuff.

It made a wonderful bag, though:

This is the little bag hanging out next to a 1.5 l bottle of water, for size comparison.

And this picture will show you the amazing stretchability of sprang:

Yes, it will hold four of these water bottles without complaint. It might even hold five, but the cord drawn in at the top (the other place where you have to secure your elements) limits the maximum opening of the bag's top. I think it's still impressive.

Friday 13 November 2015

All kinds of cool stuff.

Today, you are getting all kinds of cool stuff!

First of all, for all of you who read German, one of my friends has written a book called "Von der Badewanne ins Haifischbecken - ein Survival Guide für junge Designer".

If you are working in a creative job, or think about working in a creative job, or know somebody, this book is a wonderful read and really, really helpful. (I finally got to realise that some of my issues are completely normal, and not due to my being not good enough, or whatever.) You can buy it directly from the publisher, as print version or as ebook.

More German: when I was in Hallstatt for the last NESAT conference, we were treated to a tour though the famous salt mines and got to see the archaeological digs in there. We were also shown a tool replica, and Hans Reschreiter (who gave us the tour) explained that they hadn't yet found out how to use this tool efficiently. Apparently someone could show them how in the meantime - as this Austrian article tells. Hooray! (For those of you who don't do German: the picks have a weird geometry, and a visiting palaeobotany researcher was reminded of a kind of scythes from his home in South Russia. The things are used with a motion coming from the hip, not the arms or shoulders.)

That's it with the German stuff for now. Time for some screenshots - you're getting a sneak preview of my new website design!

Let me know what you think of it - I'd be delighted to have some feedback!

First of all, for all of you who read German, one of my friends has written a book called "Von der Badewanne ins Haifischbecken - ein Survival Guide für junge Designer".

|

| The cat approves of Jan's book, too! |

More German: when I was in Hallstatt for the last NESAT conference, we were treated to a tour though the famous salt mines and got to see the archaeological digs in there. We were also shown a tool replica, and Hans Reschreiter (who gave us the tour) explained that they hadn't yet found out how to use this tool efficiently. Apparently someone could show them how in the meantime - as this Austrian article tells. Hooray! (For those of you who don't do German: the picks have a weird geometry, and a visiting palaeobotany researcher was reminded of a kind of scythes from his home in South Russia. The things are used with a motion coming from the hip, not the arms or shoulders.)

That's it with the German stuff for now. Time for some screenshots - you're getting a sneak preview of my new website design!

|

| Peek at the main page |

|

| A peek at the new shop page. |

|

| More of the shop! |

Let me know what you think of it - I'd be delighted to have some feedback!

Thursday 12 November 2015

The day is drawing nearer.

I've spent the last two days partly fiddling with the new website and partly relaxing, and now it's time to have full work days again. I've been writing and translating some content for the new site, there's been re-ordering of menu items and checking links, and there has been much (and dirty) fighting with wayward CSS (not made easier by the fact that I don't know much about CSS).

However, things are finally getting more into a semblance of order than before. There are still a few issues to solve (such as no proper spot for the language switcher that will allow you to skip seamlessly from the German page to the English one), and there's some more checking and setting up to do, but I can see the light at the end of the tunnel. (Since I don't hear train sounds along with that, I'm pretty confident it will all end well.)

So... provided that I can manage to deal with all the remaining issues sometime next week, it will go live soon. I'm really looking forward to that shiny new webpage! With slideshow! And a fancy dropdown menu!

However, things are finally getting more into a semblance of order than before. There are still a few issues to solve (such as no proper spot for the language switcher that will allow you to skip seamlessly from the German page to the English one), and there's some more checking and setting up to do, but I can see the light at the end of the tunnel. (Since I don't hear train sounds along with that, I'm pretty confident it will all end well.)

So... provided that I can manage to deal with all the remaining issues sometime next week, it will go live soon. I'm really looking forward to that shiny new webpage! With slideshow! And a fancy dropdown menu!

Wednesday 11 November 2015

How to make yourself very tired.

Here's a good recipe on losing some sleep, in a thoroughly enjoyable way:

Have an idea for a conference.

Find a place to run it, organise a caterer, and a place for the participants to stay.

Find about a dozen other people who are passionate about textile research, and historical textiles, and the crafts involved.

Get all of them, plus tools and books and materials, together in said place you organised - to share knowledge and try out things, for one whole week.

Throw a little experiment in with the mix...

... and there you go.

There was sprang, and tea, and coffee. There was much running (at least for me - to open doors, and gates, and nip back to fetch something). There was beautiful weather, and there was chocolate, and of course we had stroopwafels (which is a Dutch sweet and traditionally used for spinning at the Forum).

There was silk reeling, and with it the admiration of both the intricate process and the dead bugs that made the coccoons.

In short, it was a wonderful week, full of textile crafts and research and learning, of friendly support of each other and discussions about which technique would be suitable, and how this or that could work. It was the European Textile Forum. It was also brutally exhausting - but I couldn't pick a better way to work on making yourself very, very tired!

Have an idea for a conference.

Find a place to run it, organise a caterer, and a place for the participants to stay.

Find about a dozen other people who are passionate about textile research, and historical textiles, and the crafts involved.

Get all of them, plus tools and books and materials, together in said place you organised - to share knowledge and try out things, for one whole week.

Throw a little experiment in with the mix...

... and there you go.

There was sprang, and tea, and coffee. There was much running (at least for me - to open doors, and gates, and nip back to fetch something). There was beautiful weather, and there was chocolate, and of course we had stroopwafels (which is a Dutch sweet and traditionally used for spinning at the Forum).

There was silk reeling, and with it the admiration of both the intricate process and the dead bugs that made the coccoons.

In short, it was a wonderful week, full of textile crafts and research and learning, of friendly support of each other and discussions about which technique would be suitable, and how this or that could work. It was the European Textile Forum. It was also brutally exhausting - but I couldn't pick a better way to work on making yourself very, very tired!

Subscribe to:

Posts (Atom)